What it really takes for financial institutions to go digital

In case you missed it, we recently released our Humanizing Customer Experience Vol 2 report, in partnership with American Banker. Learn about the key national trends, attitudes and behaviors impacting the customer experience in the financial services sector through this in-depth report. The below article is derived from one of the key chapters of the report.

What it really takes to go digital

To keep up with fintech disruptors and match the “Amazon effect,” we need to shift our digital mindset from replicating the analog to building digital experiences that leverage the authority and reach of a transformational ecosystem.

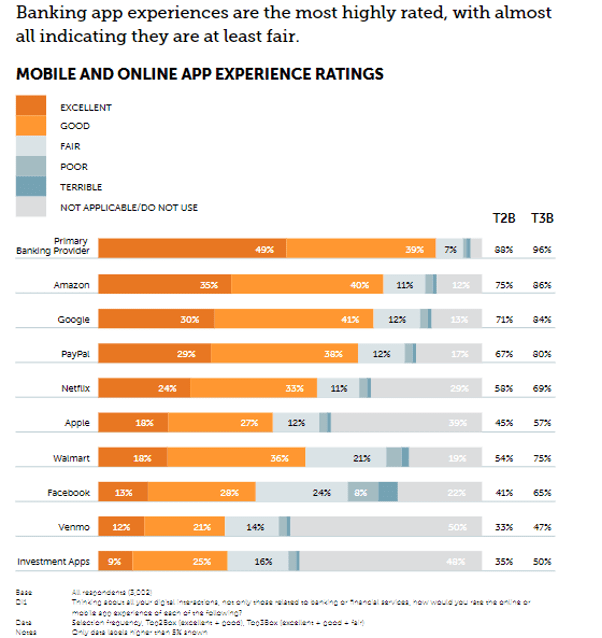

Digital is brand, and brand is digital. That’s true for Amazon, Google, Apple, and financial services and banking brands too. In general, banks and financial institutions have adapted to the basic demands of today’s digital-driven age, thanks largely to impressive mobile app interfaces and experiences. In fact, nearly all customers indicate that their banking app performs at least fairly, making it the highest-performing app across all categories asked.

However, it’s not time to pat yourself on the back and call it a digital day quite yet. Despite a relatively strong experiential performance, customer engagement with digital banking apps remains narrow. For most customers, usage is limited to basic self-service transactions (think balance monitoring and account transfers), with the majority logging in weekly or monthly at best. This consistent low engagement suggests that banks’ “strong” performance is, in reality, anchored by customers’ low expectations.

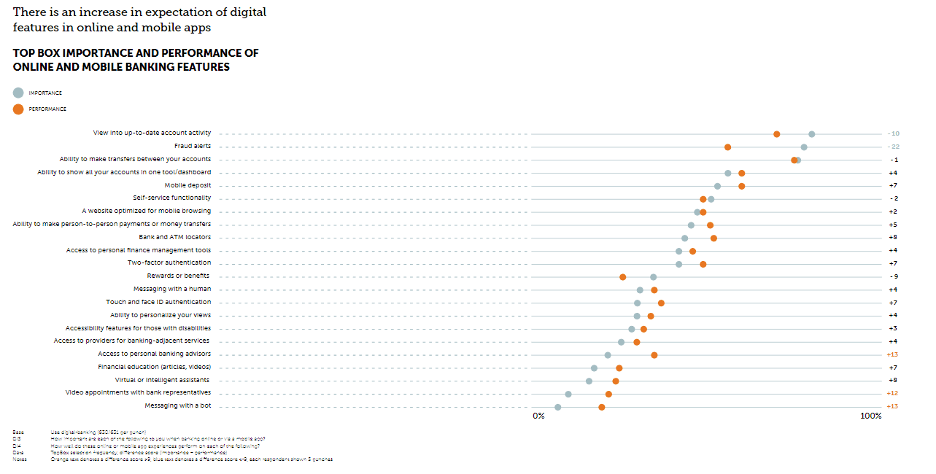

Data indicates that today’s digital banking apps offer strong procedural and urgent experiences, with limited applications and usage opportunities. The confluence of ecosystems and banking efficiencies is shifting the way people select a brand and use it to solve problems. In short, financial institutions have done well to date by building out a robust set of “monitoring” features, but have far to go to capitalize on digital opportunities.

Digital puts a personalized ecosystem in customers’ pockets

If the goal is to increase the role our brands play in customers’ lives, digital is the most direct path to take us to them. Enhanced personalization of digital services, tools, and resources could lead to increased engagement and growth by serving not only as a tool to track and check in on account status, but increasingly as a reference point for decision-making on everything from household budgeting to planning for major purchases and life events.

Consider the many action-oriented tools customers are seeking as we move from an emphasis on transaction to transformational experiences. New resources have emerged, including account aggregation, automated savings, digital wallets, carbon footprint calculators, budgeting tools, personalized advice, shared financial-management tools, credit-building programs, gig-economy marketplaces, and financial wellbeing advice and resources. While these are powerful tools, all of the disparate pieces are rarely integrated to provide end users with the best possible experience.

In addition, most financial brands optimize their brand and not its relationship to other brands. If strategically integrated and combined, the orchestration of all the varied components within your brand’s ecosystem can deliver considerable value while connecting to what today’s customers want.

Learn more: Digitally Enabled – The business case for digital

Use lifetime value to craft the ecosystem

Given the number of options available for orchestration, it may be hard to prioritize the right solution. Most brands look to improve overall experience, but the larger humanizing opportunity is delivering the right enhanced experiences to the right kind of customers. Segmentation structured around lifetime value identifies which customer needs your brand should address, by uncovering whether the portfolio of customers most likely to stay with the brand will deliver the business objectives. Examine findings through the lens of strategic questions. For example: Are we tied closely to a high-value group that is shrinking? Do we have affinity with a group that is delivering too little value? Should we pursue a fast-growing segment with a whole new set of offers? The key is forecasting how the brand will perform across all segments over time to ensure revenue goals are hit.

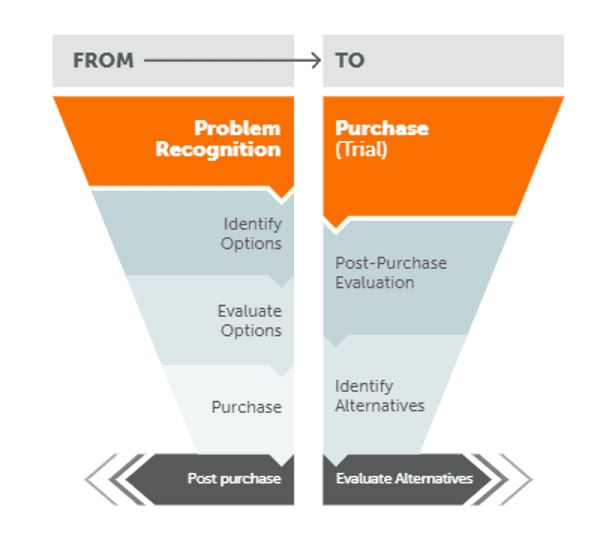

Understand that ecosystems change decision-making

The “Amazon effect” has shifted the way consumers encounter and adopt new behaviors, shifting the purchase funnel to include trials faster because brands are being presented inside the ecosystem. This has fundamentally changed our classic understanding of how to build a brand and reinforce brand behavior—it’s less about recognition and repetition and more about getting our foot in the door with emergent and personalized opportunities. Picture this: you’re scrolling Amazon when a new offering pops up. Maybe it’s for music or video streaming or a new way to purchase through their app. Because it’s already within an ecosystem you trust, you are more likely to just try it out. After all, what’s the worst that could happen? You may just find a new service you rely on. With so much built-in trust and equity, that’s the type of trial opportunity banks and financial institutions have an opportunity to leverage.

In the new purchase funnel, the “problem” is beside the point; through personalization, digital ecosystems identify what customers want and offer solutions they trust—before they are even aware of a problem to begin with.

Staying in sync with digitally disruptive fintech means winning our fair share of these types of trial opportunities—think free trades, cashback, unique savings accounts, and more. These types of trial opportunities work by capturing consumers first through short-term value, then through meaningful experiences that give reasons to stay engaged and excited.

Learn more: From competitors to collaborators, how financial institutions can adapt to a rapidly evolving landscape

Action Items:

- Use digital as the anchor to an ecosystem of brand experiences that deliver personalization and solutions for today’s customers.

- Conduct segmentation to understand lifetime value and bridge the gap between digital portfolios and top business objectives.

- Take advantage of new purchase-cycle behaviors by offering trials and incentives that generate new behaviors, use cases, and relationships while engaging customers in innovative ways.

Curious to learn more? Reach out to us, we’d love to have a conversation.

In the meantime, check out an earlier chapter from the Humanizing Customer Experience Vol 2 report – and keep an eye out for additional deep dives coming soon.