From competitors to collaborators, how financial institutions can adapt to a rapidly evolving landscape

In case you missed it, we recently released our Humanizing Customer Experience Vol 2 report, in partnership with American Banker. Learn about the key national trends, attitudes and behaviors impacting the customer experience in the financial services sector through this in-depth report.

Financial entities face new organizational questions as the divide between banking and fintech closes. With new partnerships, acquisitions, and services in your future, we explore a key question: how will your brand architecture adapt to this newly-evolved and ever-changing landscape?

Changing customer expectations have made seamless, humanizing experiences and offerings nonnegotiable. Customers demand the same level of innovation and access from their bank as from the other financial organizations they interact with: think Venmo, Digit, Truebill, Acorns, and Robinhood.

Given the increasingly competitive landscape, not to mention a precarious-feeling global economic situation, the need for banks to partner with, acquire, or develop their own fintech technologies has accelerated. In addition, customer desire for a “super-app” has grown. As a result, fintech brands and retail banks have gone from natural competitors to necessary collaborators.

This push provides a big opportunity to deliver enhanced experiences and engage customers in new ways, but it also raises new questions. As partnerships, offerings, and acquisitions increasingly come into play, how should banks organize their expanding service portfolio?

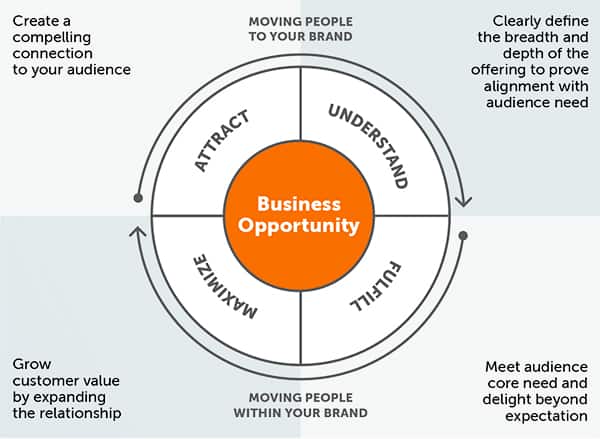

A key element to bringing brand to the forefront of a seamless consumer experience is in the way you incorporate the sub-elements or partnerships in a way that explains the value of these elements to the overall experience. The way in which we evaluate, think, and organize our brand architecture is to strategically set up the way in which consumers interact with your brand: from creating connections and matching your offering to the expectations of target consumers (moving people TO your brand) to exceeding consumer expectations and expanding the relationship with the consumer (moving people WITHIN your brand).

Architecture is a blueprint for moving people to and within your brand. This chart shows four key objectives to amplify business opportunity

Brand architecture can help set the tone for your entire brand experience, attracting new customers, solidifying relationships with current ones, and unleashing the power of your people. Done right, architecture can serve as a strategic blueprint for your brand experience, mapping directly to your consumer’s journey, needs, and behaviors. Modern brand architecture’s role has expanded to be more consumer-centric, with a goal not only to organize, but to help propel people through brand experiences in more intuitive, meaningful ways.

Organizational Brand Architecture Strategies – Two Approaches

Custom brand architecture approaches are aplenty: we see two key strategies as “the basics” on either side of the organizational spectrum. Below we outline two key brand architecture strategies, with their associated pros and cons.

1. Architecture Strategy A: The Enterprise Approach

This approach uses white labeling and in-house capability-building to bring all services and solutions under one enterprise brand. Think Apple moving from Macintosh and desktop hardware to a fleet of Music, Podcast, Books, TV, News, and more under a single masterbrand.

By taking a consistent approach with new, expanded offerings, banks can reposition their role in customers’ lives, establishing themselves as the essential, one-stop-shop partner that empowers customers to “do it all.”

PROS:

— Simple, clear, and easy for customers to navigate

— Potential to deliver big boost in brand equity

— Similar to how many banks currently organize traditional services

CONSIDERATIONS:

— Infrastructure investment (requires developing new services in-house, or acquiring and rebranding existing offerings)

— Effort of shifting customer understanding and changing behaviors

2. Architecture Strategy B: The Marketplace Approach

In lieu of a single, overarching masterbrand, this approach enables banks to focus on what they do best (security, regulation, custodial, etc.) while curating access to an ecosystem of brand partnerships at the product and solutions level. In this scenario, banks prioritize third-party fintech partnerships to offer a suite of solutions, without having to invest in the development or rebranding required by a masterbrand approach.

Amazon is a “Prime” example of this marketplace-style approach. While customers are given seamless access to a plethora of independently branded products and offerings, Amazon is free to focus on platform, distribution, and supply chain.

PROS:

— Allows banks to focus on their core strengths while providing customers with new services and niche solutions

— Smaller potential investment upfront

CONSIDERATIONS:

— Banks have less control over the experience delivered by third party partners, and they get less brand equity “credit” for the benefits provided

— Requires active brand governance attention to ensure the right relationships, licensing deals, and regulations are adhered to

Learn more: Brand Architecture series – Part 1

No matter what, you need a POV when it comes to brand architecture. Whether you decide to go all-in with an enterprise strategy or take a curated marketplace approach instead, your number-one objective should be a seamless, human experience. Implementing either strategy (or creating your own sweet spot somewhere in between) correctly will mean filling in the customer-centric experience and services gaps, such as personalized decision-support tools, automated advice, and more.

When viewed through this human-first lens, the significance of this brand architecture challenge is apparent—without a clear POV, banks will be forced into taking a clunky, case by-case approach that can get in the way of what matters: delivering consistent, personalized experiences for the people that matter most to your brand.

Key Action Items:

- Audit your current brand portfolio and architecture approach; is it consistent, strategic, and delivering the right experience for your customers in the best moments? Be sure your architecture is aligned to your strategic growth goals; if it’s not aligned, fix it.

- Get clear on how new partnerships, acquisitions, and offerings will be incorporated into your bigger portfolio through structured decision systems and portfolio strategy.

- Establish a definition for brand value to enable more structured dialogue and negotiations with partners for co-branding, co-marketing, and licensing.

Have questions about our Humanizing Customer Experience Vol 2 report or building your brand architecture strategy? We’re here to help. Let us know what challenges you’re facing by reaching out to us here.

In the meantime, keep an eye out for other deep dives into our Humanizing Customer Experience Vol 2 report.