For financial institutions, things just got (more) personal

In case you missed it, we recently released our Humanizing Customer Experience Vol 2 report, in partnership with American Banker. Learn about the key national trends, attitudes and behaviors impacting the customer experience in the financial services sector through this in-depth report. The below article is derived from one of the key chapters of the report.

Personalization as an experiential imperative is here to stay, but do you know what it really means to customers? It’s not just about great person-to-person customer service experiences anymore. Now, banks need to apply a personalized filter to every touchpoint and experience, whether it’s in-person or digital. Today’s customers are looking for a personalized approach for all of their financial needs: from savings recommendations and investing strategies to incentives and advice based on life stage.

A more active relationship means customers expect tailored recommendations and rewards

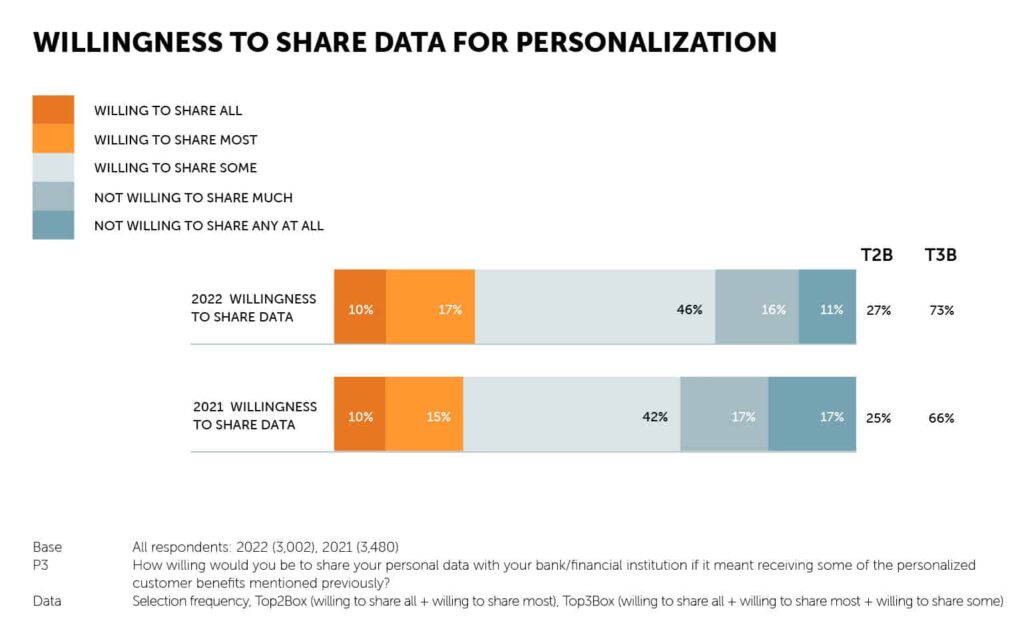

In fact, 3 out of 5 customers believe it is worth sharing personal data to receive personalization in financial services and are willing to share more data to enhance their individualized experience.

Learn more: Humanizing your Brand: A Guidebook

Personalized recommendations and next best actions hold the key to growth

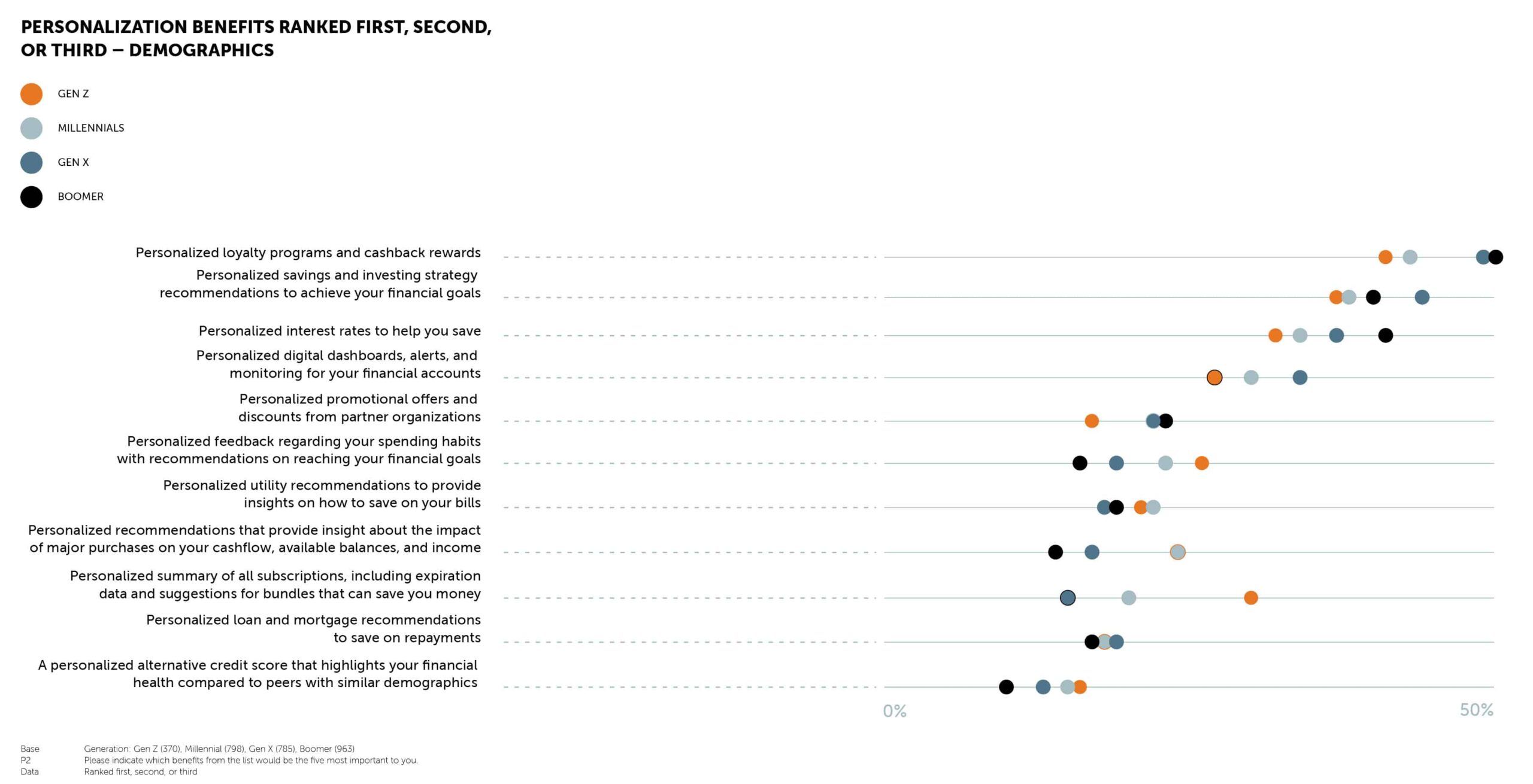

The importance of personalized savings advice and investing strategy recommendations has only increased since last year, reinforcing the need to deliver the right message and services, at the right time, to the right people. This can be accomplished through advanced digital tools and resources, paired with the in-person counsel and expertise that customers trust.

Compared to last year, even more customers are willing to share their data if it means real-time recommendations and advice tailored to their unique financial goals. As brands inside and outside of the financial industry continue to deliver new personalization-boosting features and approaches, this trend is poised to continue growing based on younger generations’ increased focus on money management tools and resources.

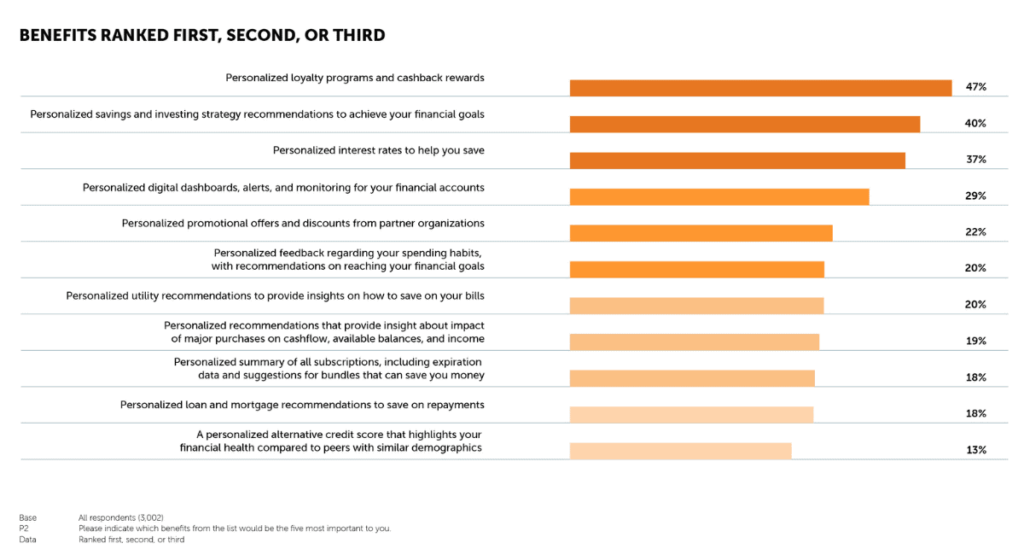

The most important personalization benefits are connected to saving customers’ money through strategies like cashback rewards, custom saving and investing recommendations, and personalized interest rates.

For inspiration, keep looking beyond banking

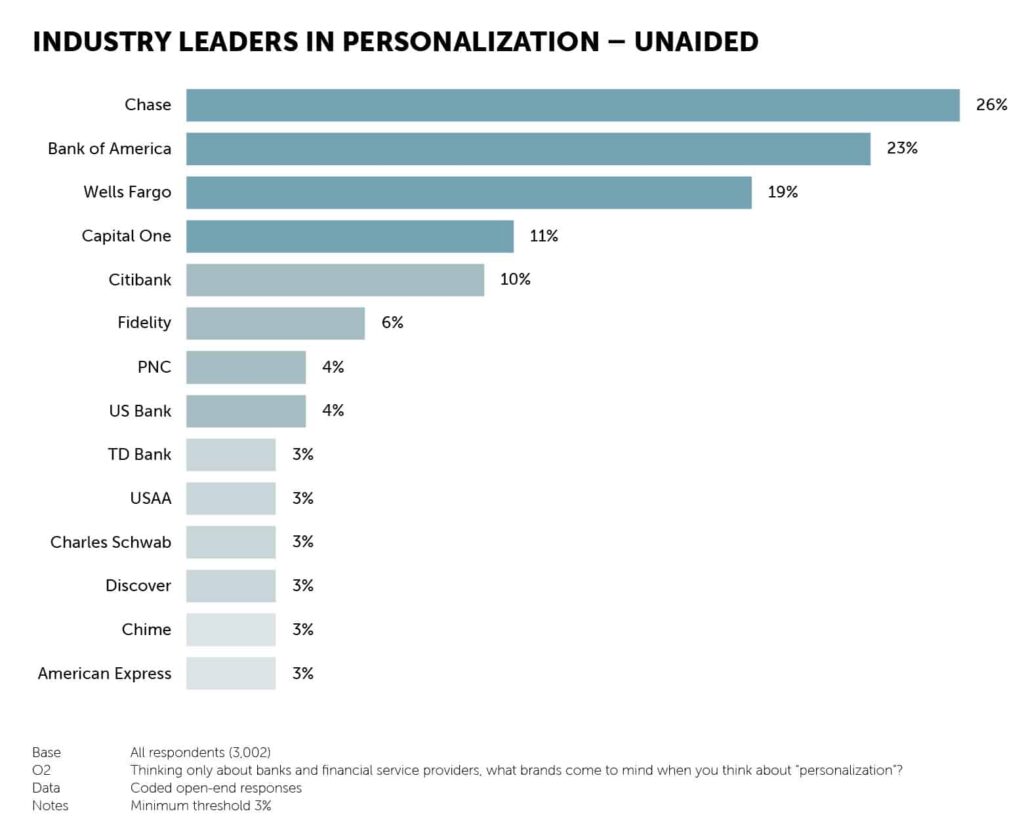

When asked to select from a list of brands, banks and financial institutions perform better than in unaided prompts, beating out the big tech brands that come rapidly to mind. This indicates that there is strength in the personalization that banking brands are offering, but they aren’t necessarily getting the top-of-mind customer credit they deserve.

To avoid losing ground in this critical area, financial institutions need to clearly connect the dots between personalization-oriented benefits like rewards, incentives, and recommendations and the day-to-day impact for individual customers. Think: impacts such as paying student loans off faster, eliminating debt, and living life to the fullest.

Learn more: From competitors to collaborators, how financial institutions can adapt to a rapidly evolving landscape

Pulling the personalization puzzle together

Customer data is a valuable asset for tracking your brand’s personalization performance— but converting that data into actionable advice is what will truly build an advantage. Differentiating your financial institution on personalization will require deep alignment across the customer journey, experience, and service interactions. To unlock the potential of personalization at your brand, start with an audit of these three components, and use additional research to define what your distinct approach should be, including incorporation of what out-of-category players are doing.

Key action items on personalization:

- Find ways to deliver on the most important personalization benefit: actively saving individual customers’ money.

- Be sure messaging and marketing are getting the story right when it comes to what personalization really means to your customers.

- Make clear connections between benefits like rewards and incentives and the human, “real world” impact they have for individual customers.

- Audit your brand’s personalization performance across the full customer journey, from digital to in-person service experience; use additional research to understand and fill the gaps.

Curious to learn more about personalization and how to apply a personalized filter to every touchpoint and experience within your brand? Reach out to us, we’d love to have a conversation.

In the meantime, check out an earlier chapter from the Humanizing Customer Experience Vol 2 report – From competitors to collaborators, how financial institutions can adapt to a rapidly evolving landscape and keep an eye out for additional deep dives coming soon.