Building Living Systems of Experience for financial brands: From diagnosis to design

The gap between brand promise and lived experience has never been more visible, or more costly. Customers can sense when organizations say one thing but deliver another, when marketing speaks of empowerment while policies create friction, when purpose sits separate from performance.

Humanizing Brand Experience: Financial Services, in partnership with American Banker is Monigle’s multi-year research initiative exploring how financial institutions can build deeper connections with customers by delivering experiences that feel distinctly human. The fifth edition surveyed 5,500+ U.S. financial services consumers, analyzing 60+ drivers across four key dimensions to understand what truly shapes consumer choice and advocacy. Through this research, we introduced Living Systems of Experience for financial institutions, a framework for creating adaptive, interconnected experiences that bring brand promises to life.

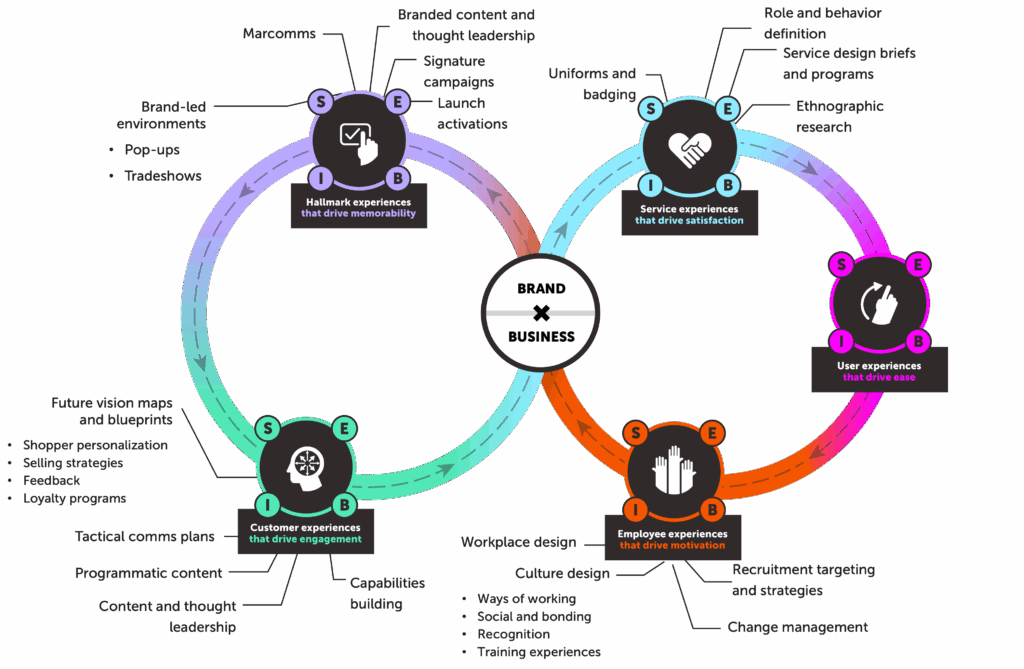

A Living System connects five critical dimensions of experience:

- Hallmark experiences: Signature moments that make your brand’s purpose tangible

- Customer experiences: How people interact with your brand across channels

- User experiences: The usability and design of your products and services

- Employee experiences: How your people feel and work

- Service experiences: The quality and delivery of your offerings

When these five experiences work in concert, they create a self-reinforcing ecosystem where every interaction strengthens the brand promise. For many leaders, the next question will be how to bring this to life inside their own organization. What does it look like to move from insight to implementation, from aspiration to activation?

Aligning brand intent with business imperatives

Before reimagining the experience, leaders need to understand how the brand, business strategy, and performance indicators intersect. When working in tandem, they create a feedback loop where purpose drives decisions, strategy enables delivery, and metrics measure what actually matters to customers.

This intersection becomes the foundation for experiences that feel coherent rather than contradictory. When these elements diverge, organizations inadvertently build systems where marketing promises one thing, operations deliver another, and success metrics track neither.

For example, while many brands continue to optimize for “best” experiences (i.e. best online banking, best mobile banking, best customer service), our Humanizing Brand Experience research revealed all of these declined significantly as experience priorities for customers. What’s rising instead are emotional outcomes: self-actualization (empowering customers to reach financial goals), belonging (making customers feel valued and understood), and navigation (making it easy to get the information they need). Simultaneously, engagement-focused behaviors declined. Willingness to subscribe to email newsletters dropped from #9 to #15, and willingness to follow brands on social media fell from #11 to #16.

The disconnect is clear: brands are too busy measuring marketing engagement and service superlatives while customers are voting for integration and trustworthiness.

The disconnect between intent and delivery

The first step toward creating a Living System of Experience is assessing the current state of connectedness. It’s identifying where brand intent and business imperatives reinforce one another, and where they work at cross-purposes. This diagnostic work reveals the organizational reality behind customer experiences. It surfaces whether teams are empowered to deliver on brand promises, whether metrics reward the right behaviors, and whether resources flow toward what matters most to customers.

This is not about rewriting strategy, but about reconciling intent and impact. Leaders must surface points of incongruence. For example, when a promise of empowerment is paired with policies that constrain autonomy, or when a culture of care is undermined by metrics that reward speed over empathy. By naming these misalignments, organizations can begin to align performance measures with purpose, creating the conditions for a system that not only functions efficiently, but also feels coherent and human.

From diagnosis to design: Building your Living System

Moving from assessment to action requires a structured yet flexible approach. The following five steps provide a roadmap for operationalizing a Living System of Experience to reshape how financial institutions work and what their customers experience.

1. Start with an honest audit of the current state

Every transformation begins with clarity. A Living Systems audit should map how experiences connect, or fail to connect, across the five dimensions of experience. The goal is to understand both how and where the brand promise comes to life, and where it is breaking down.

Ask questions that reveal alignment and friction:

- Where do our business strategies and KPIs reinforce or contradict our brand intent?

- Where is our brand promise most consistently delivered?

- Where are experiences fragmented or inconsistent with intent?

- What moments cause friction or break trust?

- How empowered are employees to deliver on the brand promise day to day?

This is more than a touchpoint exercise; it is an audit of coherence. Living Systems thrive when internal alignment mirrors the external experience. The audit should uncover both the proof points that validate the brand and the points of dissonance that dilute it.

Consider a regional bank that promises to “put people first.” An audit might reveal that branch employees consistently deliver warm, personalized service (strength), but the digital account opening process requires 47 fields and three separate logins (friction). The brand promise lives in one channel but dies in another. The audit makes this visible, creating urgency for change and clarity about where to focus.

2. Create a vision for a Living System of Experience

Once the current state is visible, the next step is to envision what a connected, adaptive system could look like for your brand. This vision should be both aspirational and operational.

It begins with the brand promise. Imagine what it would look like if that promise were delivered consistently across every lens of the experience. Picture hallmark experiences that make your purpose tangible. Customer journeys that flex by mindset and need. User experiences that anticipate and simplify. Employee experiences that reflect culture through behavior. Service experiences that demonstrate reliability and care.

The most effective visions are written in human terms. They describe how the experience should feel, not just what it should do. They connect purpose to performance, outlining the emotional outcomes for people and the measurable outcomes for the business such as stronger trust, higher product depth, lower friction, and deeper loyalty.

Be sure to ground your vision in actual customer priorities, not hypothesized ones. The 2025 Humanizing Brand Experience data reveals which emotional outcomes matter most to banking consumers: “self-actualization” (empowering customers to achieve financial goals) rose to #3 among emotional drivers, while “belonging” (feeling part of something more than a bank) fell to #8. Customers want enablement, not community theater.

Imagine that same regional bank creating a vision where every interaction, whether in-branch, on mobile, or through customer service, reinforces the “people first” promise. New customers are greeted by name in branches and online. Loan officers have flexibility to approve based on relationships, not just algorithms. Digital tools anticipate needs based on life stage. Employees across all functions can see customer context and act on it. The vision describes not just what happens, but how it feels: seen, supported, empowered.

3. Uncover barriers and enablers

Even the strongest vision will falter if the underlying system is rigid. Identifying barriers and enablers ensures that momentum is sustainable.

Common barriers include siloed org structures that prevent information sharing, legacy technology that can’t support personalization, metrics that reward individual departmental performance over holistic customer outcomes, and risk-averse cultures that punish experimentation.

Common enablers, conversely, include cross-functional alignment where teams share visibility and accountability, leadership sponsorship that gives permission to challenge the status quo, technology investments that enable rather than constrain personalization, and success metrics that balance business efficiency with customer outcomes. When enablers are strong, the system gains resilience and can evolve without friction.

Crucially, this is also where the brand–business connection must be reinforced. Align metrics so they reward behaviors that deliver on brand intent. Replace isolated targets like “reduce call volume” with integrated ones like “increase first-contact resolution with empathy.” When KPIs reflect both business and human success, the system begins to adapt naturally.

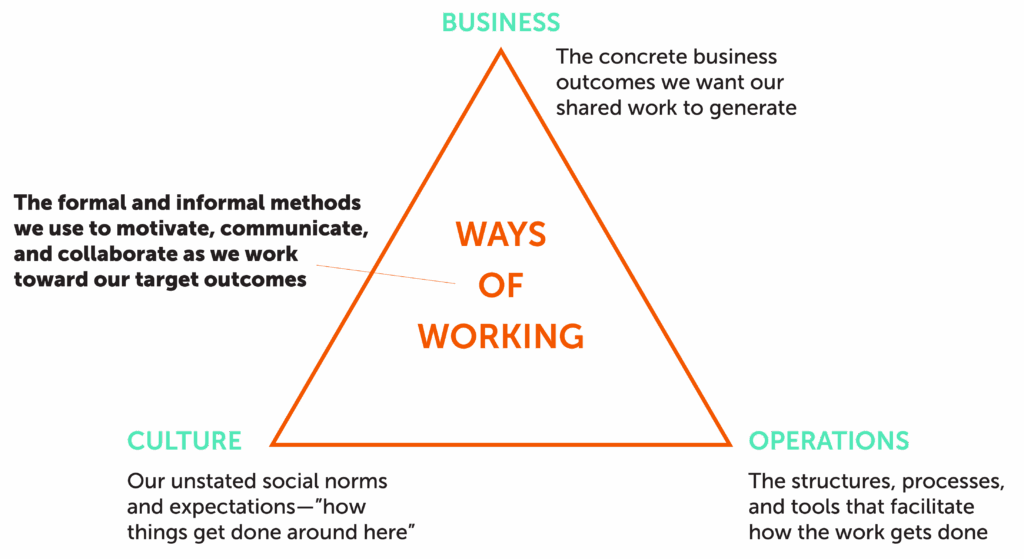

4. Set the culture and ways of working to achieve the vision

Culture is the connective tissue of any Living System. Without it, even the best frameworks remain theoretical. To bring the vision to life, brands must foster cultures that value iteration, transparency, and shared ownership.

The research confirms that ease matters more now than ever. “Navigation” (making it easy to get the information customers need) jumped from #4 to #3 in behavioral drivers, while “management” (making it easy to manage finances) rose from #7 to #4. This shift demands a culture where employees are equipped to remove friction, not add to it.

To build a culture that supports a Living System, focus on three components:

- Define principles, not rules: Equip employees with clear intent so they can interpret the brand promise in real time

- Empower the edges: Give frontline teams the tools and autonomy to solve problems at the point of need

- Celebrate progress: Recognize behaviors that bring the brand to life, no matter how small

When culture aligns with the brand’s purpose and the business’s performance model, agility becomes habit. Employees stop waiting for permission and start shaping the experience themselves.

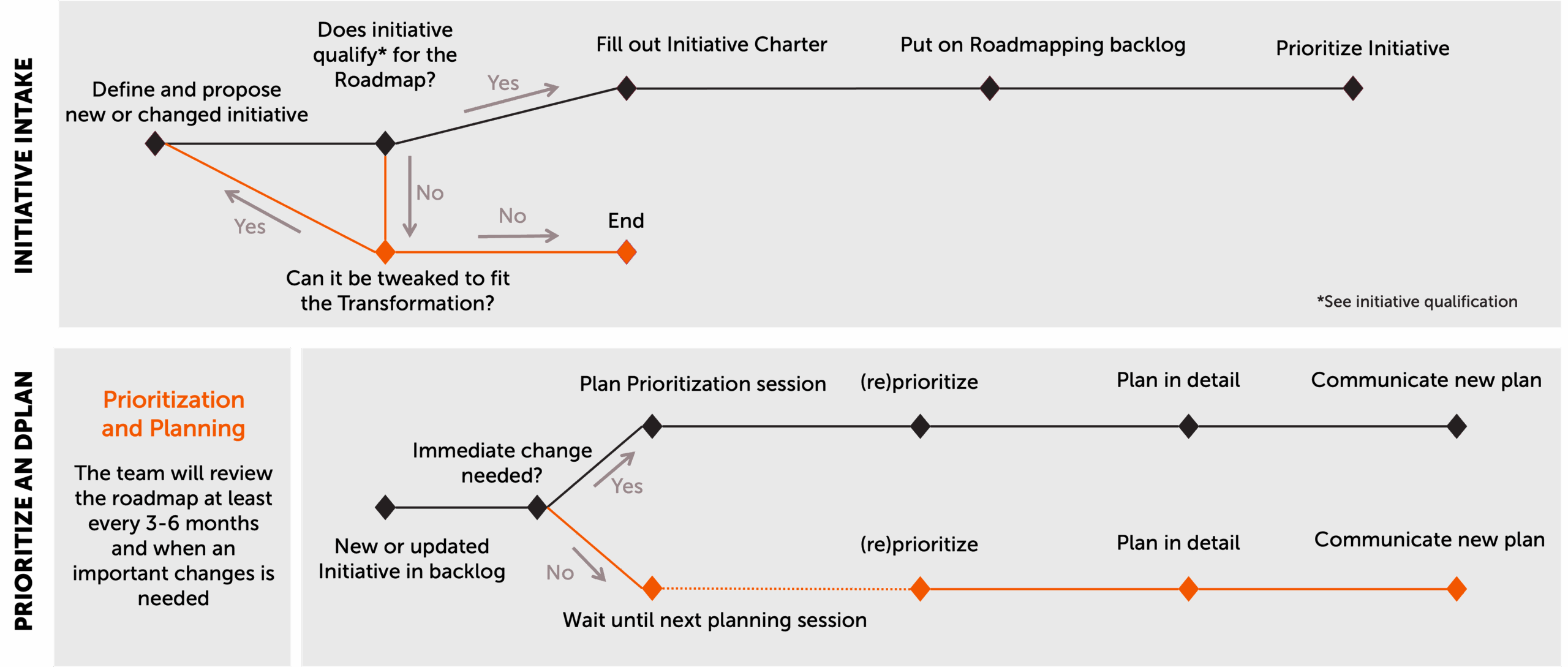

5. Work in an agile rhythm with your agency partner

A Living System is never finished, which means partnerships must evolve beyond static scopes and timelines. The best client-agency relationships work like ecosystems: iterative, transparent, and built on shared accountability.

Work in short, focused cycles. Align on hypotheses. Prototype experiences. Test, learn, and refine. Use data as feedback, not judgment. Invite your agency into your internal rhythms, rather than treating them as an external vendor. This creates a continuous loop of insight, creation, and optimization that mirrors the way customers actually experience your brand in motion, not in sequence.

From isolated moments to integrated systems

When financial institutions operationalize Living Systems of Experience, they stop managing isolated moments and start orchestrating connected ecosystems. They replace brand talk with brand proof. They align KPIs with human outcomes. They create brands that adapt as quickly as the customers they serve.

And most importantly, they humanize finance. Trust, simplicity, and empowerment stop being aspirational values and become the everyday reality people feel inside and outside the organization.

This shift from theory to practice requires both conviction and craft, with a willingness to examine how organizations truly work and the discipline to redesign experiences one decision, one interaction, and one system at a time.

To explore the full research behind these insights and dive deeper into the data shaping financial services experiences, download the complete Humanizing Brand Experience: Financial Services edition report.