Three Quick Steps to Reach Millennials

How retail banking can connect with the next generation

Oh millennials. The self-indulgent, brand switching generation that doesn’t respond to traditional advertising and will change brands at the drop of a hat.

Hands up if you’ve heard the following conversation in your organization in the last 12 months:

“Most of our customer base is in a more mature demographic, and we are struggling to find ways to connect with and acquire newer customers, especially among millennials.” If it sounds familiar, you are not alone.

We are in the midst of a pseudo-revolution in the retail banking industry. Consumers are being trained by all types of industries to expect instant access to intelligent information, deal with organizations in multiple channels. They are happy to do without human interactions in daily transactions, but want a great service experience when they need it.

Recognizing that millennials are important and hard to reach is nothing new. But, as you ponder how you can instill a bit of Uber or AirBnB magic into your bank’s brand, there are some things you can do that can set you on the right course.

Three Ways to Reach Millennials:

Define Your Brand Philosophy

What does your brand stand for? And, I am not talking about a mission statement or value proposition. To be successful within the millennial community, they want your brand to be a vehicle to project their own cultural and societal values and ways of thinking. John Mackey, CEO of Whole Foods, calls this idea conscious capitalism, which consists of a higher purpose for your brand, executive buy-in, active leadership, and an empowering culture and management. Mackey believes that explicitly stating your company’s higher purpose and core values will lead to more consistent and engaging messaging from your internal employees.

Doing so not only gives your employees something to believe in, but it creates something for your customers to buy in to. A great example of a retail bank that has implemented this strategy is CharterBank, which has developed an attention-grabbing campaign around helping millennials pursue their own track to happiness. Their marketing efforts are focused on highlighting different lifestyles and culture first, and information on their bank, second.

Purpose Must Be Driven From the Top-Down

If your brand purpose is only coming from the marketing and communications team, then you are behind the eight ball. Brand is the filter that every strategy, no matter the size of the initiative, should go through before being communicated to external and internal stakeholders. So, if your brand definition isn’t something your C-Level executives, accounting team, sales team, or customer service group isn’t consciously thinking about, then you have a major disconnect between your brand promise and customer expectations.

The brand promise needs to start with the CEO and Board of Directors and trickle all the way down to the front lines of the organization. If not, millennials will see right through it. If you are a retail or commercial bank, a great practice is to have your CEO or other C-level executives write (or ghost write) engaging and entertaining communications to the employee base each day. This will not only keep your employees engaged and consistent on the overall business strategy, but also make them feel more included and a part of the organization.

Marketing Scope is More Important than Marketing Budget

When you are trying to go after a new market segment such as millennials, usually the first question your marketing department will pose is, “Can I get an increased budget?” While budget is a necessary component, it should not be the number one priority on your strategy list. More importantly, marketing should be asking, “Can I increase the scope of our marketing efforts?” They should be asking for internal buy-in to explore more efficient ways of reaching the target segment of millennials.

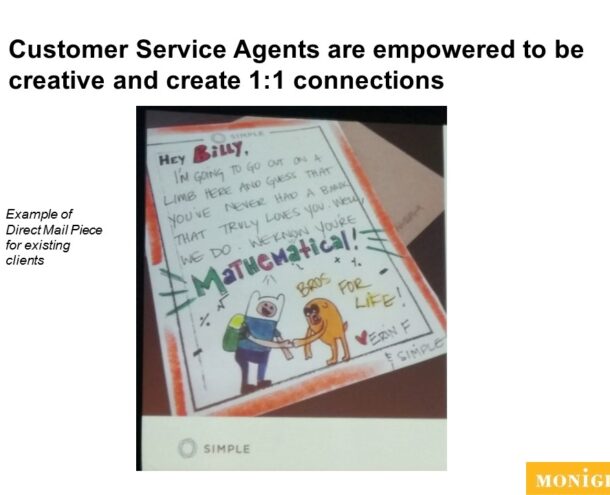

For example, instead of using saturated marketing avenues―TV, radio, print―use more relevant spaces―Facebook, Instagram, better internal training, employee engagement initiatives, etc. The great marketer Gary Vaynerchuk describes this concept as “Marketing in the Year We Live In.” For example, if no one is watching television ads anymore, then you are not using your marketing dollars efficiently by investing in this channel. A bank that has encapsulated this way of thinking is Charles River Bank. They created a campaign of Superhero mascots to help teach children about savings. This innovative initiative helped them not only teach children, but get their message out to the parents, as well. Another example is Simple Bank who provide their customer service staff with an arts and craft station to create unique personal cards for their clients.

These three steps can’t encompass your entire marketing efforts, but can get you started down the right path for furthering your customer acquisition strategy. If you’re losing customers faster than you’re adding them and your brand feels more like 1995 than 2015, perhaps it’s time to start for a fresh approach.

To learn more about branding in the financial services industry, visit our website.

Josh Berndt is a Brand Development Manager at Monigle.