For Financial Institutions, Keeping Pace Means Getting Personal

Brian Elkins is the Executive Director of Strategy and the head of our Financial Services practice at Monigle

Okay, so you’ve met your customers’ minimum basic needs. Security? Check. Trust? Check. But to deliver customer experiences that will drive growth and enhance loyalty in the current environment, your offerings need to be tailored and intelligent. The CFO doesn’t want the same product as the student. The micro-dosing techie city-dweller may engage with different offerings than the tik-tokking homesteader.

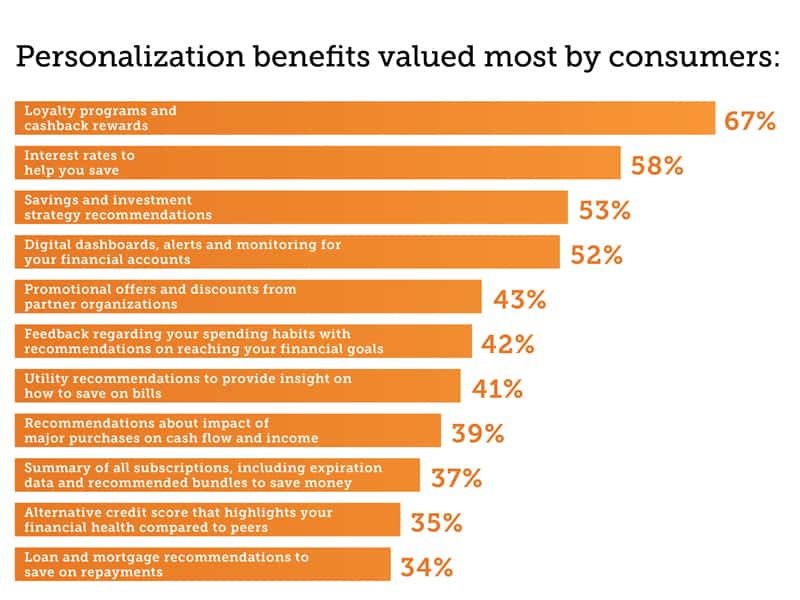

In our recent Humanizing Customer Experience Vol 1 report in partnership with American Banker, we found that personalization around advice, rewards and products resonates strongly with consumers in all walks of life. A majority of consumers are willing to share some personal data to get personalized experiences and products. Older consumers want better rates and rewards while younger consumers, especially those starting out on life’s financial journey, need more advice on savings, spending and investment. While it’s notable that age is the biggest determinant of what consumers are seeking, the basic premise around the desire for personalization remains intact.

In today’s world, personalized offerings are expected by customers, and financial institutions from upstart fintechs to well-established incumbents are taking note. In fact, a new survey from American Banker collecting banking leaders’ predictions for 2022 and beyond reveals that personalized experiences are among the top CX priorities for banks, particularly community banks and credit unions.

Learn More: Humanizing your Brand: A Guidebook

Recognizing the need and deploying tactical enhancements is one thing. Building authentic, human brand experiences is another and requires intentional realignment. Here are couple of ways the market is shaping to connect to customers on a more personal level –

Affinity-based

Platforms are increasingly catering to groups that share identity-based experiences at the intersection of common culture and financial needs. Immigrant communities often face similar challenges when it comes to remittances and the pursuit of generational wealth creation. LGBTQ+ communities have, for decades, faced lending discrimination and are looking for a financial partner they can trust.

Learn More: 3 Strategies for Building Consumer Trust

Creating offerings that authentically address the shared experiences of varying groups is not just a pathway toward financial inclusion, but a means for brands to meet consumers where they are and create value far beyond the individual assets. Examples from Daylight, OnJuno and Passbook demonstrate this potential.

Values-based

Customers want to put their money where their hearts are. We are beyond the days of platitudes and green washing. The case for doing well by doing good is not some woke-speak, but has been proven possible and desirable. People want something closer at hand than investing in ESG assets or some Green EFT. They want to see real world outcomes and have a direct line of sight from their banking to what they care about personally.

Banks and fintechs are increasingly baking this into the banking experience. The power of data makes consumers increasingly savvy and people want to know how their financial institutions (FIs) line up with their values. FIs need to be prepared not just to show the data, but put it to action and engage customers in the process. For example, Aspiration, a digital banking platform, gives 10% of its earnings to environmental organizations, gives customers an Environmental Impact Score for their purchases, and offers to offset customers’ carbon emissions from their gas purchases.

Situation-based

Which platforms and financial tools customers can use often depends on their financial standing and limitations. Many tools are inaccessible to the lower-earning brackets of a customer base. For example, a secured personal loans may require collateral, such as your home or your savings account, which not everyone can provide.

With options like “buy now, pay later” and investment platforms with low barriers to participate, the inaccessible becomes within reach. Educational components can also be a great fit for these platforms so that a customer can get to the more exclusive financial tools later on in their financial journey. The revolution of accessible finance has the potential to discard the predatory practices of old and get back to creating a real value exchange where both parties benefit.

Building personalization into your brand takes the right formula to be genuine and relevant. When we have an understanding of an audience, we can get to work on defining and delivering brand experiences that show people that we understand their evolving financial lives and are ready to deliver.

Want to dive deeper? Check out our Humanizing Customer Experience Vol 1 report to see more examples of personalization or reach out to us directly here to see how our research can move your brand.